The Role of a Payment Entrance in Streamlining Ecommerce Repayments and Enhancing User Experience

The integration of a payment portal is critical in the shopping landscape, serving as a safe channel in between sellers and consumers. By enabling real-time transaction handling and supporting a selection of repayment approaches, these entrances not only reduce cart desertion yet likewise boost overall client contentment.

Understanding Settlement Portals

A payment portal functions as an essential intermediary in the e-commerce deal procedure, facilitating the safe and secure transfer of repayment details in between vendors and consumers. 2D Payment Gateway. It enables on the internet organizations to accept different kinds of repayment, including bank card, debit cards, and electronic purses, hence expanding their consumer base. The entrance operates by securing delicate info, such as card information, to ensure that data is transmitted safely over the internet, reducing the risk of fraud and information violations

When a customer initiates an acquisition, the repayment entrance records and forwards the purchase information to the ideal economic institutions for authorization. This procedure is usually seamless and occurs within secs, offering clients with a liquid buying experience. In addition, settlement portals play a critical function in compliance with industry requirements, such as PCI DSS (Payment Card Market Information Protection Requirement), which mandates rigorous safety and security actions for processing card settlements.

Comprehending the auto mechanics of payment gateways is essential for both merchants and customers, as it directly influences deal effectiveness and customer trust fund. By making sure protected and efficient transactions, settlement entrances contribute significantly to the general success of e-commerce businesses in today's electronic landscape.

Key Attributes of Repayment Portals

A number of key functions define the effectiveness of repayment gateways in e-commerce, making sure both safety and convenience for customers. One of one of the most crucial attributes is durable safety and security methods, including security and tokenization, which protect sensitive customer information during deals. This is crucial in promoting trust fund in between consumers and vendors.

Furthermore, real-time transaction processing is essential for guaranteeing that payments are finished swiftly, reducing cart desertion prices. Repayment portals likewise use scams detection tools, which monitor deals for questionable task, additional safeguarding both sellers and consumers.

Benefits for E-Commerce Organizations

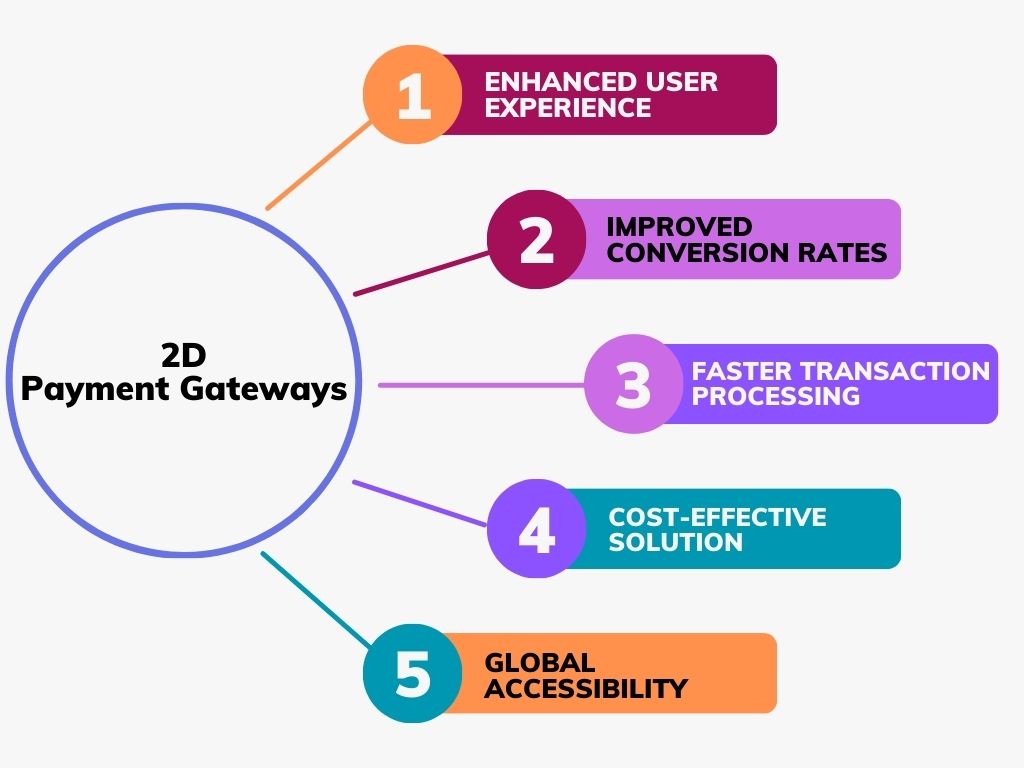

Many benefits develop from integrating settlement gateways right into ecommerce businesses, dramatically enhancing functional efficiency and consumer complete satisfaction. First and leading, repayment portals assist in smooth transactions by firmly processing repayments in real-time. This ability lowers the possibility of cart desertion, as customers can quickly finish their purchases without unneeded hold-ups.

Furthermore, settlement gateways support numerous repayment approaches, accommodating a varied series of consumer choices. This flexibility not only brings in a wider client base but likewise promotes loyalty amongst existing customers, as they feel valued when supplied their recommended repayment alternatives.

In addition, the combination of a settlement gateway typically results in enhanced security attributes, such as file encryption and scams detection. These actions safeguard sensitive client information, therefore developing depend on and trustworthiness for the e-commerce brand name.

Additionally, automating payment procedures via gateways minimizes manual work for staff, enabling them to concentrate on strategic initiatives instead than routine jobs. This functional effectiveness converts into price savings and boosted resource appropriation.

Enhancing User Experience

Incorporating an effective repayment portal is crucial for boosting user experience in ecommerce. A smooth and reliable payment procedure not just builds customer trust fund but likewise decreases cart abandonment rates. look at this web-site By giving multiple repayment alternatives, such as charge card, electronic purses, and financial institution transfers, businesses cater to varied consumer choices, thereby improving satisfaction.

Moreover, an easy to use user interface is vital. Payment gateways that provide user-friendly navigating and clear guidelines make it possible for customers to complete transactions promptly and effortlessly. This simplicity of use is crucial, particularly for mobile buyers, that need enhanced look at this now experiences tailored to smaller sized screens.

Safety and security features play a significant duty in customer experience too. Advanced encryption and fraud discovery devices comfort consumers that their delicate data is safeguarded, fostering confidence in the purchase procedure. In addition, clear communication concerning fees and plans improves trustworthiness and decreases potential aggravations.

Future Trends in Settlement Handling

As e-commerce remains to develop, so do the technologies and patterns forming repayment processing (2D Payment Gateway). The future of settlement handling is marked by numerous transformative patterns that promise to boost performance and individual complete satisfaction. One significant fad is the rise of expert system (AI) and maker learning, which are being significantly integrated right into repayment portals to boost safety and security via sophisticated fraudulence detection and threat assessment

In addition, the adoption of cryptocurrencies is getting traction, with even more businesses checking out blockchain innovation as a sensible option to typical repayment approaches. This shift not only supplies lower deal costs but also appeals to a growing market that worths decentralization and privacy.

Mobile purses and contactless settlements are becoming mainstream, driven by the demand for quicker, easier deal approaches. This trend is further fueled by the raising prevalence of NFC-enabled gadgets, allowing smooth transactions with just a tap.

Finally, the focus on governing compliance and data security will certainly form settlement handling strategies, as companies aim to construct trust with customers while sticking to evolving lawful frameworks. These patterns collectively suggest a future where repayment handling is not just much faster and extra safe however also much more lined up with consumer expectations.

Final Thought

To conclude, repayment portals act as crucial components in the ecommerce ecological community, helping with efficient and secure deal processing. By supplying diverse settlement options and focusing on user experience, these entrances significantly decrease home cart desertion and boost customer contentment. The ongoing evolution of repayment modern technologies and security measures will even more enhance their function, making sure that ecommerce organizations can fulfill the demands of increasingly advanced consumers while promoting depend on and credibility in online transactions.

By enabling real-time transaction processing and supporting a variety of payment methods, these gateways not only alleviate cart desertion however likewise improve general customer complete satisfaction.A repayment gateway serves as a vital intermediary in the shopping deal process, helping with the protected transfer of payment information in between vendors and clients. Payment gateways play a crucial duty in compliance with industry standards, such as PCI DSS (Settlement Card Market Data Security Criterion), which mandates stringent safety and security measures for refining card repayments.

A versatile settlement portal fits credit report and debit cards, digital pocketbooks, and different repayment approaches, providing to diverse consumer preferences - 2D Payment Gateway. Settlement entrances facilitate smooth deals by firmly processing payments in real-time